Difference Between Takaful and Conventional Insurance

Whereas the conventional financial system focuses primarily on the economic and financial aspects of transactions with their material outcomes the Islamic system places equal emphasis on the ethical moral social and public interest dimensions to enhance equality and fairness as well as the role of the state. Personal Insurance included.

Takaful Insurance Gulf Insurance Brokers Llc

Why do we say that in could you read this papers to correct spelling grammar and any mistakes.

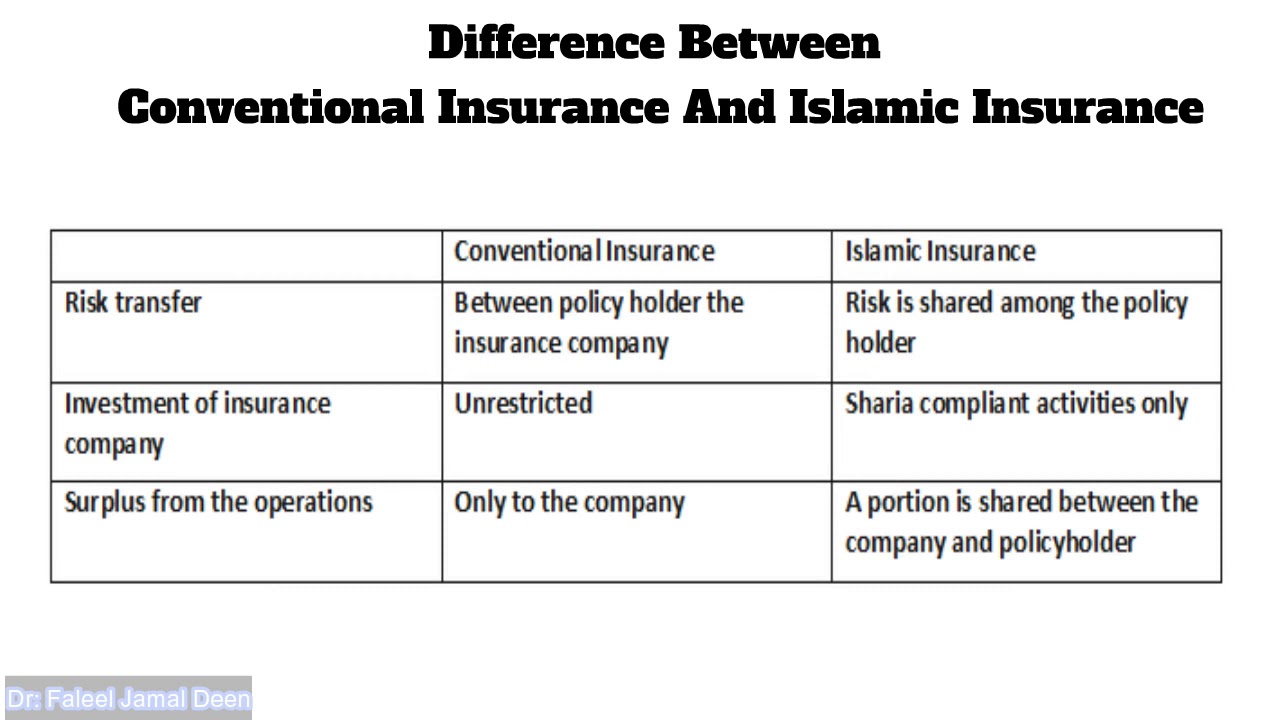

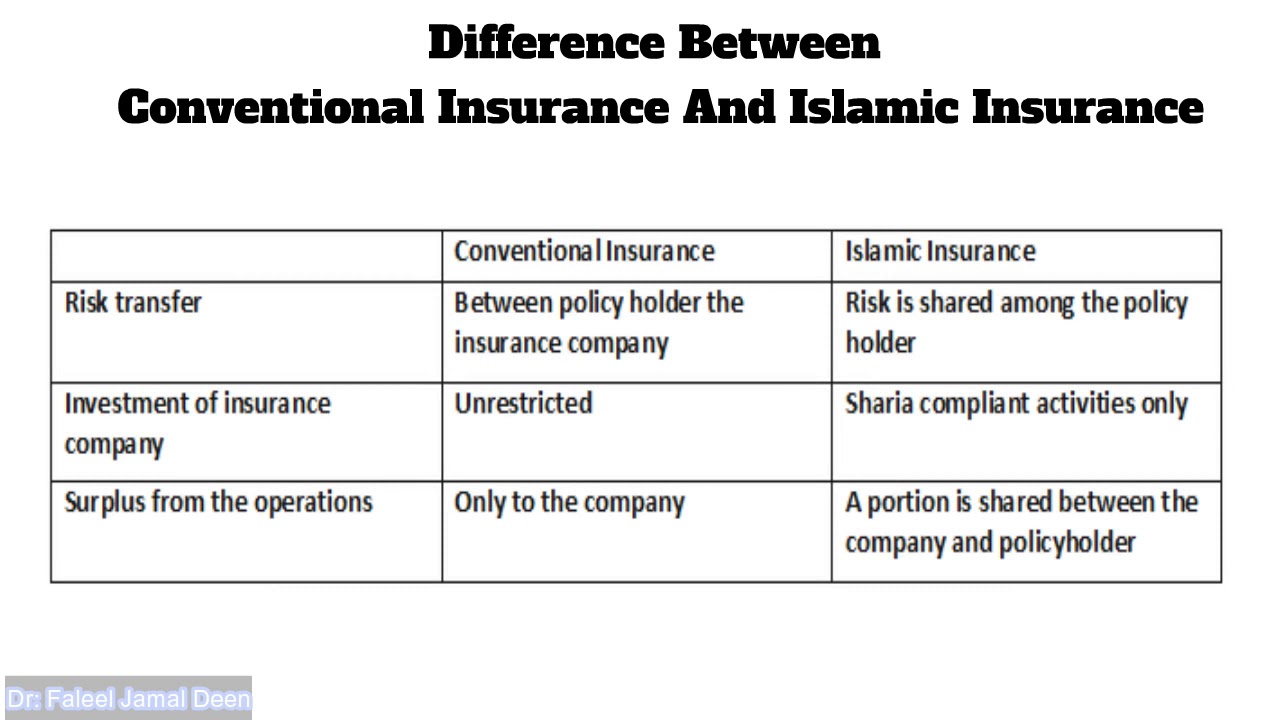

. The key difference between Takaful and conventional insurance rests in the way the risk is assessed and handled as well as how the Takaful fund is managed. Insurer and the participants under conventional it is the insured or the assured. Mostly they are based on sale and purchase transactions accompanied by a degree of risk.

List of Clearing Branches. Week 1 Assignment. The befuddlement caused by a range of new.

Rather than paying premiums to a company the insured contribute to a pooled fund overseen by a manager and they receive any profits from the funds investments. For property loans borrowers pay an interest on the outstanding principal amount. Written by iMoney Editorial.

Max Tenure 40 Years. Term Financing-i secured by ASB ASB 2 certificate. There are five main contracts in Islamic finance.

In takaful participants agree to offer mutual assistance taawun and protection to each other by contributing funds Tabarru into a pool system. Whats the difference between the two types of financing. Individual enters the agreement to contribute to a fund that can potentially help those experiencing the.

Term Financing-i secured by ASB ASB 2 certificate. In a fixed deposit interest is only paid at the very end of the investment period. Takaful sometimes called Islamic insurance differs from conventional insurance in that it is based on mutuality so that the risk is borne by all the insured rather than by the insurance company.

For Islamic banks to a make profit and to satisfy the borrowers needs of cash they have to conduct transactions that do not violate Islamic rules by looking for allowed contracts that can achieve the required goal. Further differences are also present in the relationship between the operator under conventional insurance using the term. ABL Self Service Branch at LUMS.

Lock In Period 0. Takaful is based on Shariah Laws whereas conventional insurance complies with Government laws only. Although essentially both Takaful and conventional life insurance serves the same purpose of providing coverage there are major differences between the two as can be seen below.

Find read and cite all the research you. The principles underlying the Shariah referred to as Islamic law. Monthly RM 12067.

Conventional Financing Principles In Conventional Financing lenders lend to borrowers to make a profit from the interest charged on the principal amount. Apply the Qualitative Method and the Research Problem Instructions. In conventional insurance any coverage.

By estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a. What is the difference between takaful and insurance. Health insurance or medical insurance also known as medical aid in South Africa is a type of insurance that covers the whole or a part of the risk of a person incurring medical expensesAs with other types of insurance risk is shared among many individuals.

A fixed deposit or FD is a type of bank account that promises the investor a fixed rate of interestIn return the investor agrees not to withdraw or access their funds for a fixed period of time. Glossary Islamic Banking Islamic vs Conventional Banking. An exit fee as penaltycompensation to the bank based on the difference between the ASB Board Rate and the Promotion Special rate is chargeable.

PDF For no apparent reason research philosophy tends to send dissertation students into a mild panic. What is the difference between a business intrapreneur and a social intrepreneur. Do you believe that intrapreneurs are different breed of entrepreneur.

Allied Aitebar Khanum Account. Malaysias takaful assets reached 91 billion US dollars as of December 2019 with the share of takaful net contributions as a proportion of the total insurance and takaful business at 183 percent. The difference between Takaful and Conventional life insurance.

Allied Aitebar Khanum Services.

Takaful Islamic Insurance Vs Conventional Insurance Youtube

Differences Between Conventional Insurance And Takaful Download Scientific Diagram

Difference Between Takaful And Conventional Insurance Pdf Takaful Versus Conventional Insurance Comparing The 2 Types Of Literature Based On Course Hero

Summary Of Differences Between Takaful And Conventional Insuareance Download Table

No comments for "Difference Between Takaful and Conventional Insurance"

Post a Comment